JOIN DISPUTE HOPE UNIVERSITY

Want to know the fastest way to improve your credit and increase your score? Dispute Hope's team of credit experts have got you covered.

REPAIR YOUR

OWN CREDIT

BUILD YOUR

OWN CREDIT

GET ACCESS

TO CAPITAL

EARN MONEY

WITH AI CREDIT REPAIR

START A

BUSINESS

BECOME A

HOME OWNER

Dispute Hope University

Is where everyone can become their own credit expert.

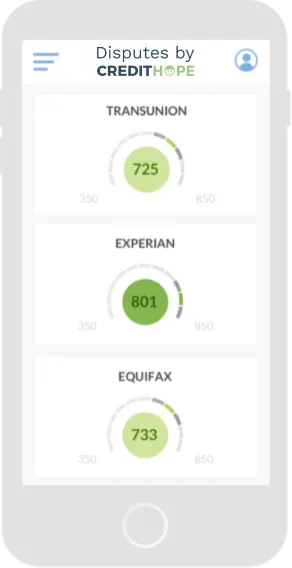

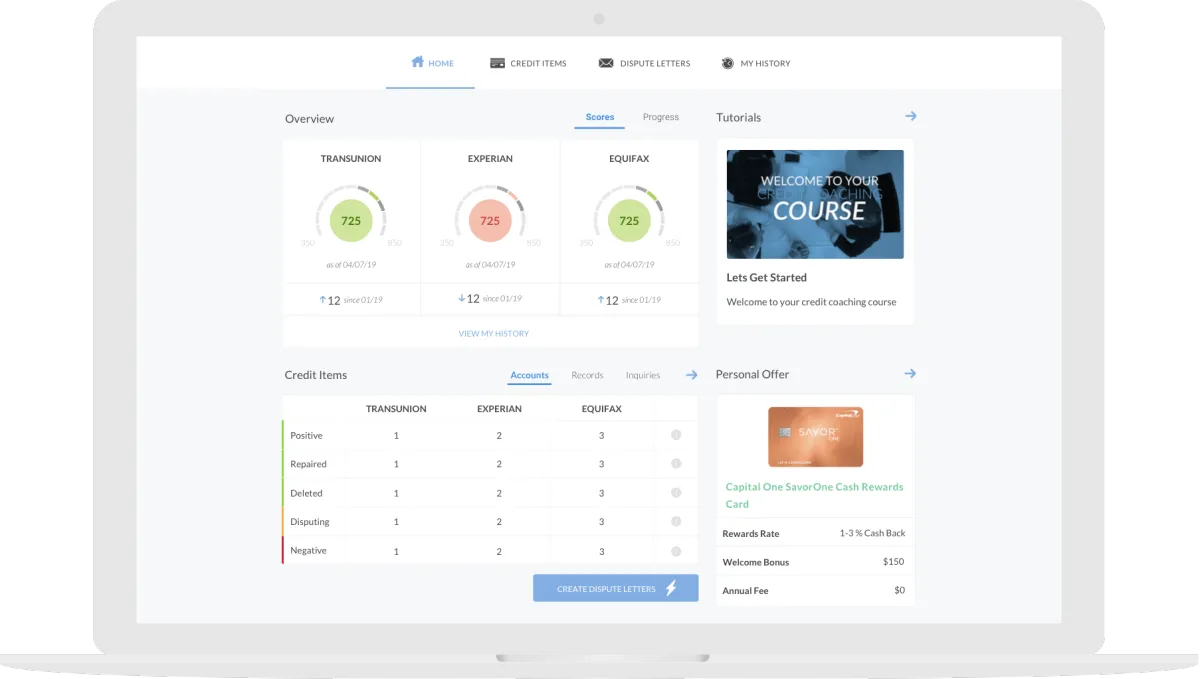

Personalized credit monitoring that tracks your progress.

Customized dispute letters specifically designed for your unique credit challenges.

My extensive library of exclusive letters that will help you clean up your third-party reporting agencies reports.

An exclusive members-only group where you can connect with me and other members for live Q&A and exclusive credit training sessions.

Credit building workshops where you’ll learn how to build your credit while repairing it.

No need to hire a credit repair company—Dispute Hope empowers you to create and send more effective disputes directly to the credit bureaus, ensuring they can't legally reject them like the generic disputes used by others.

Strategies for Effective

Disputes

Don t waste your time and money hiring a credit repair company to send generic disputes the 3 credit bureaus can legally reject.

Disputes for Guaranteed Results

Dispute Hope software helps you create far more effective disputes than any credit repair company. Because you send them yourself, the credit bureaus won't reject them.

Effortless Disputes, Elevated Scores

Easily create effective disputes for all 3 credit bureaus and improve your credit score with ACU Ai software.

Meet Dispute Hope

Dispute Hope is so smart and easy to use, you might think it’s magic.

Repair all 3 credit bureaus. Increase your credit score. Easily do it yourself.

Dispute Hope can help you delete these accounts from Experian, Equifax, and TransUnion

Late Payments

Collections

Repossessions

Judgments

Charge Offs

No Need To Hire a Credit Repair Company

Dispute Hope is a credit repair expert so you don’t have to be.

Smart Import

Dispute Hope automatically imports your 3 bureau credit report without creating a hard inquiry.

Brilliant AI

Dispute Hope Artificial Intelligence knows which accounts are hurting your credit and helps you create powerful disputes to remove them.

Unlimited Disputes

Dispute as many accounts as you want on all 3 bureaus at the same time. It doesn’t matter if you have one account or fifty accounts to dispute, Dispute Hope can easily manage and track all of them.

Professional Letters

Letters are far more effective at getting accounts permanently deleted than online disputes. Dispute Hope letter generator helps you create effective disputes based on consumer protection laws.

Track Your Results

Every month Dispute Hope imports your new 3 bureau credit report and shows which accounts were deleted and your new credit scores. If an account wasn’t deleted, Dispute Hope will suggest a new strategy for additional disputes.

How It Works

No more spending hours studying your credit report, researching how to delete accounts, writing disputes, and keeping track of the results. Dispute Hope manages everything for you.

1. Link your credit report

Dispute Hope automatically imports and analyzes your 3 bureau credit report, finds negative accounts, and prepares an aggressive dispute strategy. Dispute Hope never puts an inquiry on your credit report.

2. Disputes that work

Dispute Hopes brilliant AI knows that different negative accounts require different dispute strategies. For example, disputing a collection account is different than disputing a bankruptcy. Dispute Hope helps you create the right dispute to achieve a permanent deletion.

3. Track your results

Dispute Hope tracks all of your disputes on all 3 credit bureaus. Every month you'll receive a progress report showing what accounts were deleted and your new credit scores. You'll always know what's going on with your credit repair and credit score.

Frequently Asked Questions

How does your AI Credit Repair Software work?

Our AI Credit Repair Software analyzes credit reports, identifies errors, and generates dispute letters to improve credit scores.

What kind of credit issues can your software help me with?

Our software can help you identify and dispute errors such as incorrect personal information, fraudulent accounts, inaccurate balances, and outdated information on your credit report.

How accurate is your software in identifying credit issues and fixing them?

Our software uses advanced algorithms to accurately identify credit issues and generates customized dispute letters that are highly effective in fixing credit errors. However, the ultimate outcome depends on the accuracy and completeness of the credit reports provided by the credit bureaus.

Can your software handle multiple credit reports from different credit bureaus?

Yes, our software can handle multiple credit reports from different the three credit bureaus and consolidate the information into one easy-to-read report for analysis and dispute.

Is your software compliant with regulations such as the Fair Credit Reporting Act (FCRA)?

Yes, our software is fully compliant with regulations such as the Fair Credit Reporting Act (FCRA) and other laws that govern credit repair. We take compliance very seriously and ensure that our software and services adhere to all relevant regulations.

How long does it typically take for your software to start improving my credit score?

The time it takes for our software to start improving your credit score depends on various factors such as the number and complexity of errors on your credit report, the responsiveness of credit bureaus, and the accuracy and completeness of the information you provide. In general, you may start to see improvements in your credit score within a few weeks or months of using our software.

What kind of customer support do you offer if I have questions or issues with the software?

We have customer support if you have questions. Email us at [email protected]

How secure is my personal information when I use your software?

The time it takes for our software to start improving your credit score depends on various factors such as the number and complexity of errors on your credit report, the responsiveness of credit bureaus, and the accuracy and completeness of the information you provide. In general, you may start to see improvements in your credit score within a few weeks or months of using our software.

Are there any additional fees or hidden costs associated with using your software?

No, there are no additional fees or hidden costs associated with using our software. You do have to pay $29.95 for credit monitoring.

What kind of results can I expect from using your software, and are there any guarantees or warranties?

While we cannot guarantee specific results, our software is designed to identify and dispute credit errors that could be negatively impacting your credit score. We have helped many customers improve their credit scores and achieve their financial goals, but the outcome ultimately depends on various factors such as the accuracy and completeness of the credit reports provided by credit bureaus. We offer a satisfaction guarantee and will work with you to resolve any issues or concerns.

Terms Of Use | Privacy Policy © 2024 Dispute Hope University, All rights reserved.

888-675-2982